The Buy and Hold Strategy in the Bitcoin Universe

The Buy and Hold strategy is a fundamental concept in the world of investments, and in the context of Bitcoin, it gains an even more relevant dimension. Unlike short-term speculation, which seeks to profit from daily market fluctuations, Buy and Hold proposes a long-term approach: acquire an asset and hold it in your portfolio for an extended period, ignoring momentary volatilities.

In the case of Bitcoin, this strategy is particularly powerful due to its deflationary nature and its potential for exponential appreciation. Historically, Bitcoin has shown an upward trend in the long term, despite its notorious and intense oscillations. Investors who adopted Buy and Hold from Bitcoin's early years reaped significant returns, proving the effectiveness of this strategic patience.

The philosophy behind Buy and Hold in Bitcoin is based on the belief that the cryptocurrency, as a disruptive technology and a form of decentralized digital money, will continue to gain global adoption and recognition. Daily fluctuations are seen as "noise" on the path to a larger growth trend. Holding Bitcoin during downturns, or "hodling" (a term popularized in the crypto community meaning to hold the asset), allows the investor to benefit from the subsequent recovery and growth.

It is crucial, however, that this strategy is accompanied by a solid understanding of Bitcoin's fundamentals and adequate risk management. Volatility is an inherent characteristic of this market, and the ability to remain calm and convinced during downturns is what differentiates long-term investors from speculators.

Digital Scarcity: Why is Bitcoin Unique?

One of the fundamental pillars supporting Bitcoin's value and long-term potential is its programmed scarcity. Unlike fiat currencies, which can be printed infinitely by central banks, Bitcoin has a fixed maximum supply of 21 million units. This characteristic makes it a deflationary asset by nature, similar to precious metals like gold, but with the advantage of being digital and globally transferable.

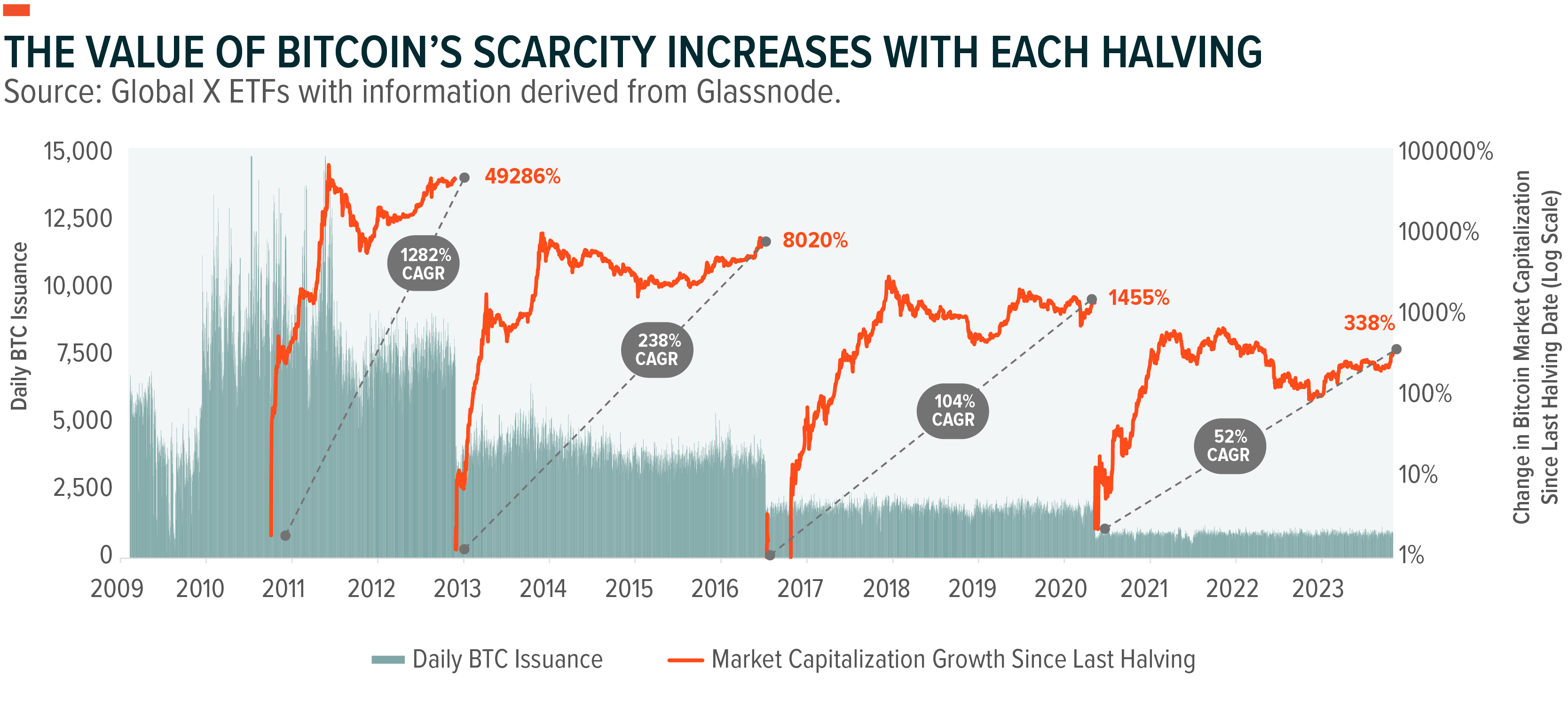

Bitcoin's scarcity is guaranteed by its source code and the "halving" mechanism. Approximately every four years, the reward miners receive for validating transactions and adding new blocks to the blockchain is cut in half. This event reduces the rate of new Bitcoin issuance, making it progressively scarcer over time. The last halving occurred in 2024, and the long-term effects on supply and demand are widely debated and expected to drive value.

This limited supply, combined with growing demand driven by global adoption, institutional recognition, and the search for an alternative store of value, creates a scenario of potential appreciation. In a world where fiat currencies lose purchasing power due to inflation, Bitcoin presents itself as a safe haven, a way to preserve and even increase purchasing power over time.

Understanding Bitcoin's scarcity is vital for any investor. It is not just a technical feature, but an economic principle that differentiates it from almost all other financial assets. It is this digital scarcity that gives Bitcoin its "digital gold" status and positions it as a strategic asset for the future of finance.

Future Perspectives for Bitcoin and the Crypto Landscape

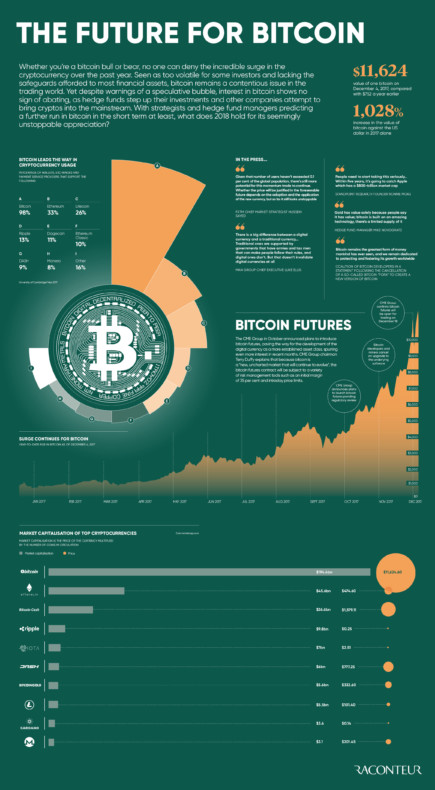

The future of Bitcoin is a topic of intense debate and speculation, but current trends point to an increasingly central role in the global financial landscape. Institutional adoption, regulatory clarity, and the continuous development of blockchain technology are factors that will shape the cryptocurrency's trajectory in the coming years.

The approval of Bitcoin ETFs in major markets, such as the United States, has opened the doors to a massive flow of institutional capital, making Bitcoin more accessible to traditional investors. This institutionalization not only legitimizes the asset but also increases its liquidity and stability. Furthermore, the growing acceptance of Bitcoin as a payment method by large companies and the exploration of its technology by governments and central banks indicate a deeper integration into the global economy.

Another crucial point is technological advancement. Scalability solutions, such as the Lightning Network, are making Bitcoin transactions faster and cheaper, overcoming one of the network's main challenges. Innovation around the Bitcoin blockchain, including the development of Ordinals and other applications, expands its use case beyond a simple store of value.

Despite challenges such as volatility and the need for a more robust global regulatory framework, Bitcoin continues to consolidate itself as a disruptive force. Its decentralized, censorship-resistant, and limited-supply nature positions it as an attractive alternative in a constantly evolving financial world. The future prospects are promising, with many analysts predicting that Bitcoin will continue to grow in value and influence, redefining the concept of money and investment.

Contact

For questions, suggestions, or partnerships, please contact us via email: